Renters Insurance in and around Tualatin

Welcome, home & apartment renters of Tualatin!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

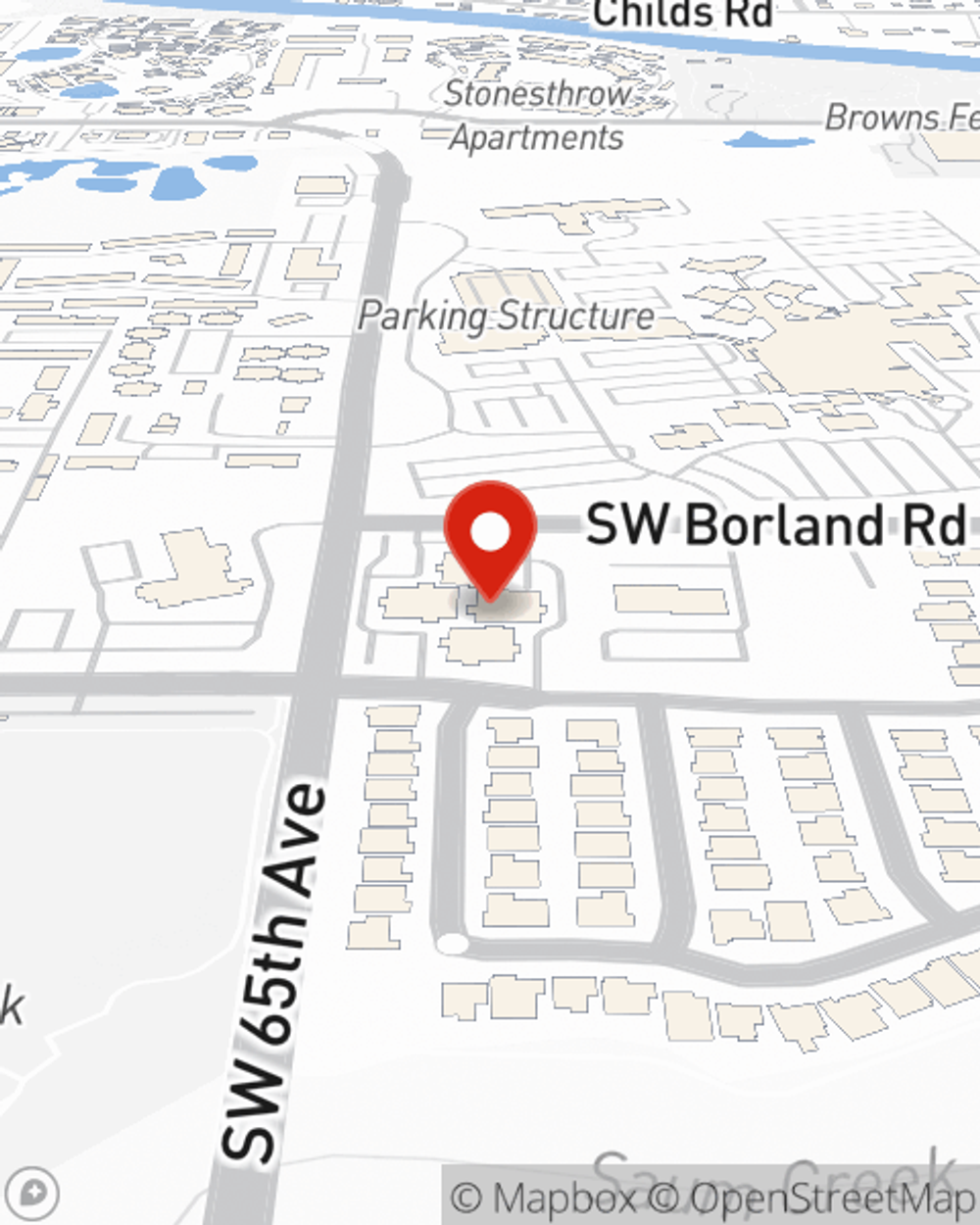

There are plenty of choices for renters insurance in Tualatin. Sorting through coverage options and deductibles to pick the right one is a lot to deal with. But if you want great priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy incredible value and straightforward service by working with State Farm Agent Jennifer May. That’s because Jennifer May can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including musical instruments, swing sets, electronics, appliances, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Jennifer May can be there to help whenever trouble knocks on your door, to get your homelife back to normal. State Farm provides you with insurance protection and is here to help!

Welcome, home & apartment renters of Tualatin!

Rent wisely with insurance from State Farm

Protect Your Home Sweet Rental Home

You may be doubtful that Renters insurance is really necessary, but what many renters don't know is that your landlord's insurance generally only covers the structure of the property. The cost of replacing your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

State Farm is a value-driven provider of renters insurance in your neighborhood, Tualatin. Get in touch with agent Jennifer May today and see how you can save!

Have More Questions About Renters Insurance?

Call Jennifer at (503) 635-9200 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Jennifer May

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.